Non-fungible token.

An NFT is a digital asset that represents real-world objects like art, music, in-game items, and films. They’re bought and traded online, often using cryptocurrency, and they’re usually encoded with the same software as many other cryptocurrencies.

Despite the fact that they’ve been around since 2014, NFTs are gaining popularity as a more popular means to buy and sell digital art.

NFTs are also one-of-a-kind, or at the very least one of a very small run, and contain unique identifying codes. This is in sharp contrast to the vast majority of digital products, which are nearly always available in endless quantities. If a certain asset is in demand, cutting down the supply should theoretically increase its value.

However, many NFTs have been digital works that already exist in some form elsewhere, such as legendary video clips from NBA games or securitized versions of digital art that are already floating around on Instagram, at least in these early days.

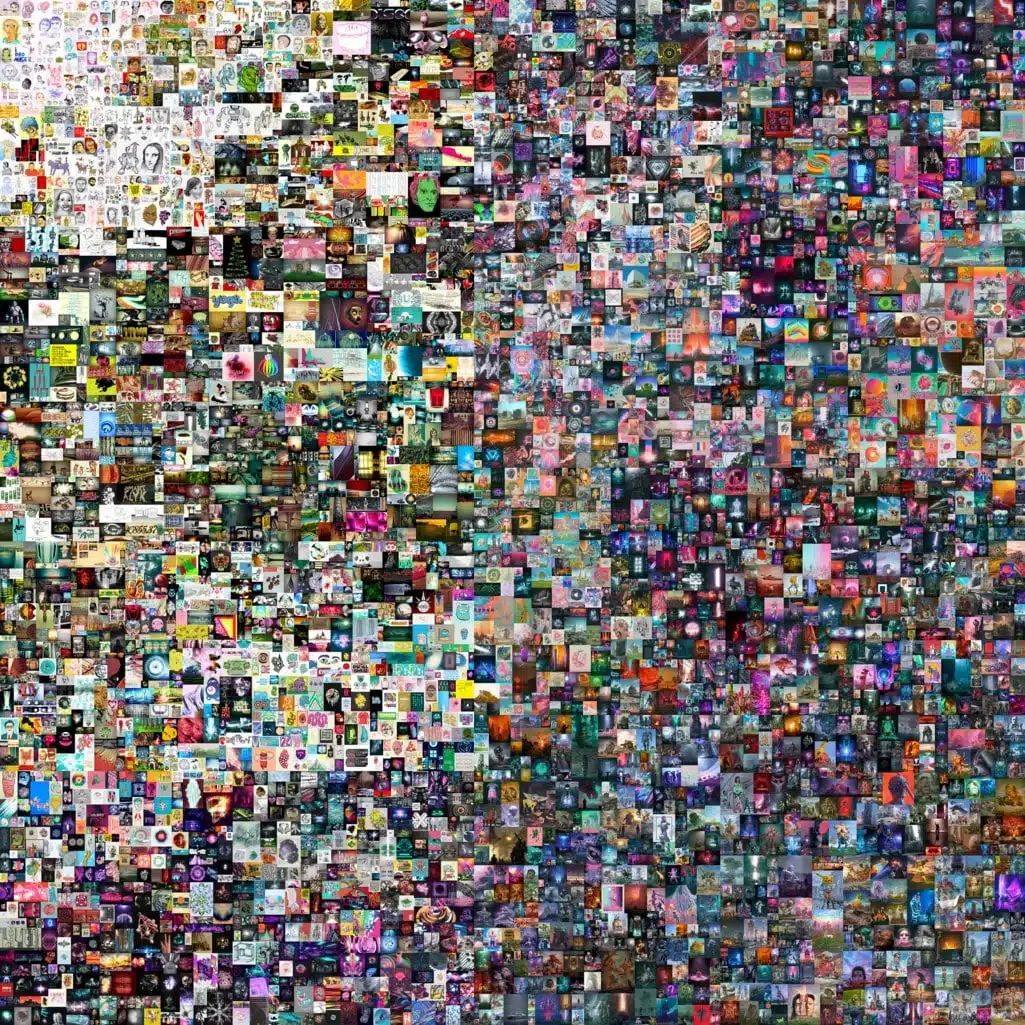

For example, acclaimed digital artist Mike Winklemann, better known as “Beeple,” created “EVERYDAYS: The First 5000 Days,” possibly the most famous NFT of the moment, which sold at Christie’s for a record-breaking $69.3 million.

Individual images can be viewed for free on the internet. So, why are people prepared to spend millions of dollars on something that might be easily screenshotted or downloaded?

Because aa NFT permits the buyer to keep the original object. It also comes with built-in authentication, which acts as proof of ownership. Those “digital bragging rights” are almost as valuable as the item itself to collectors.

Non-fungible basically means that it’s one-of-a-kind and can’t be substituted with anything else. A bitcoin, for example, is fungible, meaning you can exchange one for another and get precisely the identical thing. A one-of-a-kind trade card, on the other hand, cannot be duplicated. You’d get something altogether different if you swapped it for a different card.

What is the Difference Between an NFT and Cryptocurrency?

The term “non-fungible token” refers to a token that is not replaceable. It’s usually programmed in the same way as cryptocurrencies like Bitcoin or Ethereum, but that’s where the similarities end.

Physical money and cryptocurrencies are both “fungible,” which means they may be traded or exchanged for each other. They’re also worth the same amount: one dollar is always worth another dollar and one Bitcoin is always worth another Bitcoin. The fungibility of cryptocurrency makes it a secure way to execute blockchain transactions.

NFTs are unique. Each contains a digital signature that prevents NFTs from being substituted for or compared to one another (hence, non-fungible).

How do NFTs work?

NFTs are stored on a blockchain, which is a decentralized public ledger that keeps track of transactions. Most people are familiar with blockchain as the underlying technology that allows cryptocurrencies to exist.

Most NFTs are part of the Ethereum blockchain. Ethereum, like bitcoin and dogecoin, is a cryptocurrency, but its blockchain also enables these NFTs, which store additional information that allows them to function differently from, say, an ETH coin. It’s worth mentioning that various blockchains can use NFTs in their own ways.

NFTs are essentially digital versions of tangible collector’s artifacts. As a result, rather than receiving an actual oil painting to put on the wall, the customer receives a digital file.

They also obtain exclusive rights to the property. It’s true: NFTs can only have one owner at a time. Because NFTs include unique data, it’s simple to verify ownership and transfer tokens between owners. They can also be used to hold specific information by the owner or author. Artists, for example, can sign their work by putting their signature in the metadata of an NFT.

Artists and content creators have a one-of-a-kind opportunity to monetize their work thanks to blockchain technology and NFTs. Artists, for example, no longer have to sell their work through galleries or auction houses. Instead, the artist can sell it as an NFT straight to the consumer, allowing them to keep a larger portion of the profit. Additionally, artists can integrate royalties into their software so that they receive a share of sales when their work is sold to a new owner. This is a desirable feature because most artists do not receive subsequent proceeds after their first sale.

What can you buy in the NFT supermarket?

An NFT is made up of digital objects that represent both tangible and intangible objects, such as:

- Art

- Collectibles

- Designer Sneakers

- GIFs

- Music

- Tweets (Jack Dorsey, the guy who started Twitter, sold his first ever tweet as an NFT for more than $2.9 million.)

- Videos and Sports Highlights

- Virtual Avatars and Video Game Skins

NFTs can be anything digital, but the current buzz is focused on utilizing the technology to sell digital art.

Do people truly believe this will become a form of art collecting?

A lot of the discussion revolves around NFTs as an evolution of digital fine art collecting.

There has already been a person who paid over $390,000 for a 50-second Grimes video and a person who spent $6.6 million for a 10-second Beeple video. In fact, one of Beeple’s works was auctioned at Christie’s, the world-famous auction house.

How can I buy an NFT?

If you’re interested in starting your own NFT collection, you’ll need the following items:

To begin, you’ll need a digital wallet that can hold both NFTs and cryptocurrencies. Depending on what currencies your NFT provider takes, you’ll probably need to buy some cryptocurrency, such as Ethereum. Coinbase, Kraken, eToro, and even PayPal and Robinhood now allow you to buy cryptocurrency with a credit card. After that, you’ll be able to transfer it from the exchange to your preferred wallet.

When researching your alternatives, keep fees in mind. When you acquire crypto, most exchanges charge at least a portion of your transaction.

There are many of NFT sites to choose from once you’ve set up and funded your wallet. The following are the largest NFT marketplaces at the moment:

- OpenSea.io: is a peer-to-peer marketplace that sells “rare digital items and collectibles.” To get started, simply create an account and browse the NFT collections. You can also sort pieces by sales volume to discover new artists.

- Rarible: Rarible is a democratic, open marketplace that allows artists and creators to issue and sell NFTs, similar to OpenSea. The platform’s RARI tokens allow users to vote on features such as fees and community regulations.

- Foundation: On Foundation, artists must earn “upvotes” or an invitation from fellow creators to post their work. Because of the community’s exclusivity and high cost of entrance (artists must also purchase “gas” to mint NFTs), it is likely to attract higher-quality work. Chris Torres, the developer of Nyan Cat, for example, sold the NFT on the Foundation platform. It might also imply higher prices, which isn’t necessarily a negative thing for artists and collectors looking to profit if demand for NFTs stays the same or even rises over time.

Although these and other platforms are home to hundreds of NFT artists and collectors, do your homework before purchasing. Some artists have been defrauded by impersonators who have listed and sold their work without their knowledge.

Furthermore, the verification methods for creators and NFT listings vary by platform, with some being more strict than others. For NFT listings, OpenSea and Rarible, for example, do not require owner verification. Buyer safeguards appear to be limited at best, therefore it’s wise to remember the old adage “caveat emptor” (let the buyer beware) when buying NFTs.